Investment Objectives

Investment Objectives Investment objectives are the goals you aim to achieve with your investments. They act as a roadmap, guiding you towards choosing the […]

Investment Objectives Investment objectives are the goals you aim to achieve with your investments. They act as a roadmap, guiding you towards choosing the […]

Investment Operations Investment operations is the backbone of the financial industry, ensuring the smooth functioning of investment activities. It’s essentially the behind-the-scenes work that […]

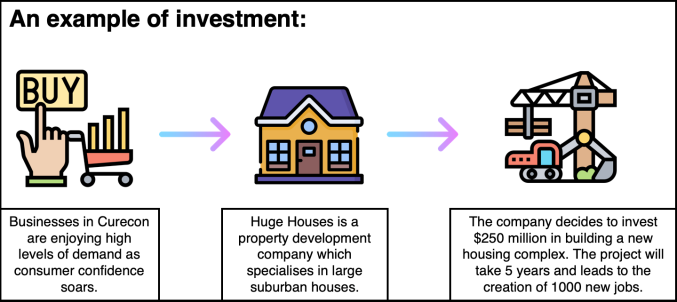

Investment Examples There are many different types of investments, each with varying levels of risk and return potential. Here are some examples across different […]

Long Term Investment The Power of Long-Term Investment: Building Wealth Over Time Long-term investing is a proven strategy for building wealth and achieving financial security. […]

Bonds Investment Bonds are a type of investment that represents a loan to a borrower, such as a corporation or government. When you invest […]

Investment Risk Investment risk refers to the inherent uncertainty associated with investing, meaning there’s a possibility you might not get back the full […]

Investment Diversification What is Investment Diversification? Investment diversification is the practice of spreading your money across different types of investments. The goal is to […]

Copyright © 2025 | WordPress Theme by MH Themes