Investment Property

Investment Property Investment property can be a great way to build wealth and generate income. Here’s a breakdown of some key things to consider […]

Investment Property Investment property can be a great way to build wealth and generate income. Here’s a breakdown of some key things to consider […]

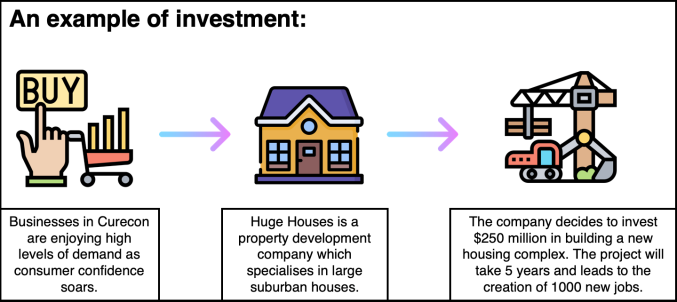

Investment Examples There are many different types of investments, each with varying levels of risk and return potential. Here are some examples across different […]

How To Investment Property There are several ways to invest in property, and the best approach for you will depend on your financial goals, […]

Investment Expenses Investment expenses are the costs associated with buying, holding, and selling investments. They can eat into your returns, so it’s important to be […]

Investment Real Estate Investment real estate refers to properties acquired and held not as a primary residence, but for the purpose of generating income or […]

Copyright © 2025 | WordPress Theme by MH Themes