Investment Objectives

Investment Objectives Investment objectives are the goals you aim to achieve with your investments. They act as a roadmap, guiding you towards choosing the […]

Investment Objectives Investment objectives are the goals you aim to achieve with your investments. They act as a roadmap, guiding you towards choosing the […]

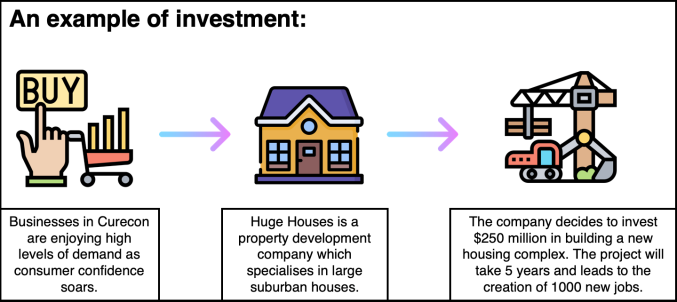

Investment Examples There are many different types of investments, each with varying levels of risk and return potential. Here are some examples across different […]

Investment Equation There isn’t a single universal “investment equation” that applies to all situations. However, there are a couple of key metrics used to […]

how much return on investment Unfortunately, I can’t tell you exactly how much return on investment (ROI) you’ll get from an SIP (Systematic Investment […]

Investment Return Investment return, also known as return on investment (ROI), is a metric used to assess the profitability of an investment. It essentially […]

Return On Investment Return on Investment (ROI) is a metric used to evaluate the efficiency or profitability of an investment. It essentially compares the gain […]

Copyright © 2025 | WordPress Theme by MH Themes